This is the second in a series of four articles that were first posted in 2007 in the Council's online magazine Policy Innovations.

HOW WE CAUSE THE RESOURCE CURSE

The oppression of the citizens of Equatorial Guinea and plundering of their country's oil wealth may strike outsiders as a cause for sympathy. Perhaps an aid program would help the Equatorial Guineans with health and education, or Western leaders could pressure President Obiangto share more of the oil money with his people. These kinds of proposals may not spark much optimism—aid money is often captured by repressive governments, and rich dictators often resist a good deal of Western pressure. Still, the sense remains that something should be done to help these Africans in their dire conditions.

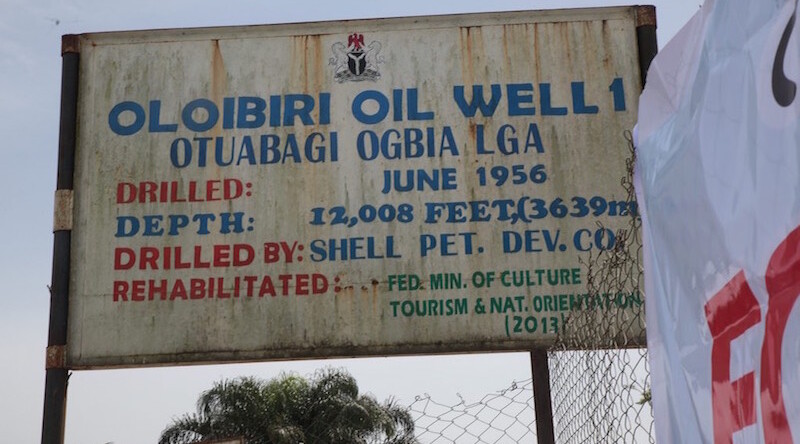

This natural course of thinking overlooks a morally significant fact. Outsiders to Equatorial Guinea are already doing a great deal regarding the plight of those citizens—outsiders are making it worse. The resource curse is only half about resources. After all, Obiang cannot subdue his political opponents by dousing them in crude oil. The other half of the equation—the more important half—is the foreign money that flows into the dictator's bank accounts. The money that outsiders pay for the resources of Equatorial Guinea ends up being used against the people of that country.

We do not like to think of ourselves as contributing to severe political repression and avoidable poverty, even if only indirectly. The thought that a percentage of what we pay at the pump is spent on Obiang's security forces or personal jets is not at all welcome.

One might dismiss this as just a fact of modern life. In a globalized market economy we typically do not and often cannot know where goods originate or where our money goes. A sense of separation emerges: It is very unfortunate that the Equatorial Guineans have a political problem in their country. But it is in the end their problem, and we should try to help them (if at all) through private charity or through the influence of our government.

This way of looking at the effect outsiders have on the fate of Equatorial Guinea is particularly inadequate from a market perspective. The resource curse does not fall on poor countries because of their resource abundance. The "curse" lies in the failure of the rules that allocate control over these resources. The fault is not in nature, but in human institutions—here specifically markets.

CITIZEN OWNERSHIP OF NATURAL RESOURCES

The resource curse results from a failure to enforce property rights. The natural resources of a country belong, after all, to its people. This principle is part of a commonsense understanding of today's world. If Russia were to drill a long diagonal pipeline under Alaska and siphon out oil, the American people would be up in arms. One can imagine similar outrage were the American president to declare that he was selling Alaska's oil for his own profit. The American people own America's natural resources, and anyone wishing to use these resources may only do so if they have some sort of authorization from the people.

The nations of the world have embedded the principle that peoples own resources deep within international law. Article 1 of the International Covenant on Civil and Political Rights asserts, "All peoples may, for their own ends, freely dispose of their natural wealth and resources." The principle of ownership by the people is also enshrined in many national constitutions. For example, the (American-approved) Iraqi constitution of 2005 proclaims, "Oil and gas are the property of the Iraqi people in all the regions and provinces."

MIGHT MAKES THE RIGHT TO SELL?

A thief who steals your watch from your nightstand cannot legally sell your watch to anyone else. The thief may have taken possession of your watch and then transferred possession to someone else, but no valid transfer of title has taken place. The watch is still your property; the thief and his buyer have merely handled stolen goods.

The analogy holds for the right to sell natural resources abroad. Does anyone besides the people have the right to sell off the resources of a territory so that they are permanently beyond the people's control? The traditional answer has been that the government of a country has this "resource right." The government is the representative of the people and thus empowered to conduct such transactions.

The question is whether the resource right vests in any party who merely asserts it, whether any group claiming the rights of governance must be thought to have the resource right. The answer to that question must of course be "no." It cannot be that anyone who declares the right to sell someone else's resources thereby gains that right.

Here we uncover the provision in the system of international trade where common sense gets derailed. In current international practice, all that is necessary for a group to be vested with the legal right to sell a territory's resources is coercive control over a territory's people. According to this customary rule, might makes right—specifically, might makes the legal right to transfer property.

This provision makes a mockery of the principles of ownership. It also generates the incentives that reinforce the resource curse.

The existence of this international might-makes-right rule calls for explanation. Some have noticed that the convention is quite convenient for rich countries, which get continuous access to poor countries' resources regardless of who is in charge there. While this seems plausible, it is also plausible (and compatible) to see this aspect of international practice as a holdover from the previous era of international law based on absolute state sovereignty.

For hundreds of years, might did make right within a territory's borders. Whoever maintained coercive control over a population was recognized internationally as having near-total discretion over the country's internal affairs. This old rule of unqualified internal sovereignty helps explain the persistence of the might-makes-right rule for resource sales. These old rules, however, do not justify current international practice.

RESOURCES AND THE HUMAN RIGHTS REVOLUTION

The human rights revolution that began with the Universal Declaration of Human Rights in 1948 has been extremely successful in displacing the idea of absolute sovereignty in international law. The basic thrust of human rights doctrine is to insist that the rulers of a country must not do certain things to its citizens, such as torture them or enforce their enslavement. Moreover, rulers must do certain things for citizens, like protect their personal property and secure them fair trials. The old excuse of "internal affairs" is no longer valid; securing human rights is now a condition for legitimate rule. Every nation on earth has by now ratified a major human rights treaty.

The might-makes-right norm that enables the resource curse is an anachronistic remnant of the pre-modern world of absolute sovereignty and colonial rule. A capacity for violent domination should not give a regime legitimate authority over citizens' resources any more so than over citizens' bodies and freedoms. Once the old idea of unqualified sovereignty is given up in the one case, it crumbles in the other as well. Indeed there need not be a resource rights revolution to follow the human rights revolution. Each people's right to its resources is a human right, and this is a right affirmed in major treaties ratified by the great majority of nations including all of the leading powers.

The most important reform of international trade must be the removal of the might-makes-right rule. Unlike popular ownership of resources, this rule is nowhere codified or ratified in international law. It persists by custom because powerful global actors have strong interests in maintaining the status quo. Removing this rule is the first crucial step in bringing all trade in natural resources within the scope of enforced market rules.