Every capitalist economy struggles with how to come to terms with greed, says John Paul Rollert, an expert on the intellectual history of capitalism. He describes how our perspective has changed from the Christian view of greed as an unalloyed sin, to the 18th century idea that it could bring positive benefits, to the unabashed "Greed is good" ethos in the movie "Wall Street." Where do we stand now? How can we rehabilitate capitalism?

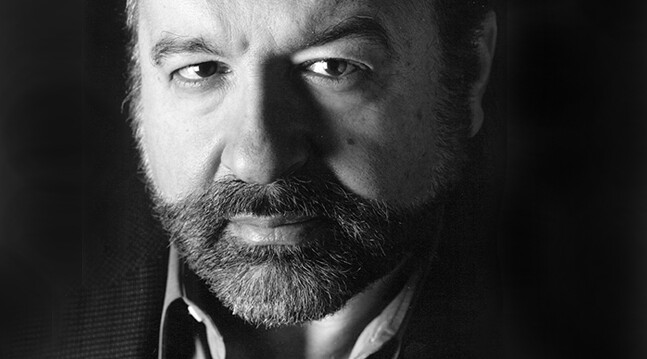

DEVIN STEWART: Hi, I'm Devin Stewart here at Carnegie Council in New York City, and today I'm speaking with John Paul Rollert. He is an adjunct professor at the Booth School of Business at the University of Chicago in Chicago, USA.

John Paul, thank you so much for coming by.

JOHN PAUL ROLLERT: It's great to be here, Devin.

DEVIN STEWART: You're a bit of an expert on the vice or the sin of greed, which is maybe a universal characteristic among all humans all around the world and certainly something that has been a challenge for all societies in creating virtuous societies, virtuous economies, and fair economies.

Before we get to the history of greed, which you have a whole lecture about, why do we need to know about greed? Why is it important?

JOHN PAUL ROLLERT: That is a great question. From my perspective, one of the central struggles in the West, in any country that has chosen to take on capitalism as a way of organizing its economy, is coming to terms with greed.

If you go back to, say for example, the 17th and 18th centuries when the arguments that are familiar to us today vis-à-vis capitalism are coming about, you have individuals wrestling with the moral status of self-interest generally. When do pursuits of self-interest tip over into selfishness and therefore greed?

To a certain extent, a lot of these thinkers are trying to figure out how do they make their peace with a passion that—at least throughout Western history in the Christian West, I would say—has always been morally dubious. If you go into Dante's Inferno, I believe in the fourth circle of hell, those who have been consigned to oblivion for greed spend all of eternity pushing around boulders, smashing into each other, the idea being that they're more concerned about the worldly goods than they are the heavens above.

When you get to this point in the 17th and 18th centuries when individuals, say for example, Bernard Mandeville and later Adam Smith, are coming to terms with the idea that actually allowing people to pursue their commercial self-interest yields a material bounty that benefits all of us, that may be all well and good, but how then do you deal with the secondary effects of greed? Even if greed brings about this material wealth, which brings people out of poverty, which alleviates concerns of starvation and people dying of exposure, what do you do about the fact that greedy behavior still remains morally antagonistic and something that undermines a sense of community?

That's a struggle that we even have today. There's plenty of behavior that we can see around us that we recognize has a kind of antisocial quality to it, but we put up with it because we assume that the material benefits that come from it are worth putting up with. Does that therefore make greed good, or does that simply make greed tolerable? I think that's a question that we spend a lot of time wrestling with even today, almost 300 years after people began the wrestling match with the concern for greed.

DEVIN STEWART: When you say first order of side effects or the sort of unintended consequences of greed, what do you have in mind? In my mind, I think of corruption. I think of maybe theft. I think of envy. What are some of the things that worry you about the bad parts of greed?

JOHN PAUL ROLLERT: If you look back throughout, again, Western history, there was always this concern that when people are greedy by nature, they're prizing their own concerns over the concerns of anyone else: friends, family, the broader community. Doing that tends to kind of unravel the social fabric.

The example that I often give to my students is that if you go out to dinner with someone—let's say you go out for pizza—and that individual spends the entire two hours talking about himself and then eats all the pizza that's put on the table, it's a little bit frustrating, and you probably would not choose to go out to dinner again with that person.

If you have individuals who are always prizing their own interests over the interests of anyone else, quickly it gives rise to a lot of the very qualities you're describing, because they have no sense of duty or moral obligation to anyone else around them.

Again throughout most of Western history, this wasn't a great problem. People recognize selfish behavior as having no moral benefit whatsoever. But the moment you're trying to weigh the passions you were describing, whether it's pride, vanity, envy, arrogance—

DEVIN STEWART: The Christian philosophers talked about this.

JOHN PAUL ROLLERT: Christian philosophers talk about it a great deal—as against the material benefits that may come about by letting people be informing their choices by those passions, you're in this weird moral weighing where you're trying to sort out what I would call incommensurable goods: How do I understand the friction that comes about from selfish behavior versus the food, shelter, and clothing that perhaps is afforded by allowing that behavior to flourish? That's always a really tense balancing act.

In the early part of the 20th century, John Maynard Keynes has a couple of wonderful essays that I think are actually relevant to this particular moment in time. One is the "Economic Possibilities for our Grandchildren"—2030; the other is "The End of Laissez-Faire."

What Keynes says is that capitalism does a great job at satisfying those material needs. It does, perhaps, less of a good job satisfying those spiritual needs. When you're in a developing society and you can't take for granted having food in your stomach tomorrow, you might err on the side of satisfying those material needs and say that we'll get to the spiritual needs later.

But when you live in an affluent society, an opulent world where you don't have that nagging fear of dying of, say, starvation or exposure, suddenly you might be willing to trade off, I don't know, more and better Cheetos for the opportunity to have those spiritual needs ministered to, the concerns for dignity, self-respect, concerns for opportunities, maybe social equality. There may be tradeoffs between those concerns and the material needs that maybe greed can help satisfy.

DEVIN STEWART: Isn't that where civil society and the polity and citizenship come in? You can't really put a price on things like trust or loyalty or beauty, right? What about the role of noneconomic actors?

JOHN PAUL ROLLERT: Early on when Adam Smith writes An Inquiry into the Nature and Causes of the Wealth of Nations, when he would get these kinds of concerns that you're describing, he would always say, more or less—I'll paraphrase—it is true that there's a danger in allowing people to pursue their material self-interest but guess what? We have a lot of other interests that are important to us. You described some of them: the concerns for family, for friends, for leisure, for meaning.

But a lot of those concerns take shape in a very intimate community. Smith will always talk about the butcher, the baker, and the brewer. These are very much small-town figures in capitalism. For anyone who has ever lived in a small town, you understand that doing business and leading your personal life can't be entirely disentangled.

When we make this move to the modern world, we are most times dealing with individuals with whom in a commercial setting we don't actually have an intimate relationship. When was the last time you walked into a CVS to buy some shaving cream, and you knew the person intimately across the counter? I can say for myself that has actually never happened.

DEVIN STEWART: I don't use shaving cream.

JOHN PAUL ROLLERT: You don't use shaving cream at all, exactly. I do, and so I can say that has never, in fact, happened to me.

Once we come into a world where we don't have those social relationships underpinning our commercial behavior, it actually can, I think, give rise to the very kinds of fears of selfishness run wild, which Smith seems to think insofar as commerce is done in a close set of community relationships, the "parade of horribles" of self-interest will never simply take shape because there will always be tradeoffs in terms of our material self-interest versus other kinds of interest we bring to bear.

DEVIN STEWART: John Paul, we have a live studio audience here today, and we are going to get to those questions from the audience soon. I want to really pick your brain about a couple more things, particularly because you have a two-hour lecture on the history of greed. Can you give us the sort of dummy's version of it? What are the three or four biggest milestones in the history of greed that our listeners on this podcast need to know?

JOHN PAUL ROLLERT: Sure. I think the first and the most important thing is before, say for example, just about the early part of the 18th century, there seemed to be nothing morally redeeming in greedy behavior.

Part of the revolution that comes about with Adam Smith and Bernard Mandeville and others is this weighing act I described earlier: Greedy behavior may have negative side effects, but it also has positive benefits.

The way in which Bernard Mandeville would famously describe it is that "private vices lead to public benefits." What that means is that you have to do that kind of weighing, which is somewhat uncomfortable.

In the modern world, as I have already said, I think we have gotten to a point where maybe some of the material benefits of greed have outlived their usefulness or perhaps maxed out. Now we kind of begin the struggle where maybe we are going to trade back some of the material benefits in order to minister more to nonmaterial interests.

I think the interesting thing about the present moment is that if you take, for example, the ethos of "Greed is good" from Wall Street, the famous movie from 1987, at some point if you lose track of what those tradeoffs are, you can suddenly make greed a virtue unto itself.

That is very different from the way in which anyone in the 18th and 19th centuries would have seen it. When you make greed a virtue unto itself, you actually are taking all of the friction that collects around greed, and suddenly you're describing it as, for example, the benefits of disruptive behavior or the wages of creative destruction.

Suddenly you take behavior that everyone always appreciated as being negative in nature but were willing to maybe put up with for those material benefits and, to a certain extent you're gilding them in some way. There's a real danger there because when you lose sight of the downsides of greed, you're reifying those downsides and unleashing them in a way that I don't think someone like Adam Smith could have ever fully anticipated.

That gives rise, I would say, to a vision of capitalism I tend to call "renegade capitalism" where the central belief is that the best thing you can do is look at the way in which things are in terms of a cultural, moral, political, and social status quo, and what can you look to disrupt? Where can you find ways to make waves?

There are not just commercial costs to that; there are cultural costs to that, too. I think we have lost sight of that.

The most famous theorist of this is Joseph Schumpeter, who gives rise to this vision of creative destruction. Schumpeter is always very honest that there isn't just creation that goes on; there's destruction. It's not just economic destruction; it is social and cultural destruction as well. If you lose sight of that, then you lose sight of the downsides of these practices, and there's no way to dial back those dangers.

DEVIN STEWART: Would you describe our current type of capitalism here in the United States as renegade?

JOHN PAUL ROLLERT: I think there are certainly elements of it. I think that to the degree that we are a little bit careless in our embrace of greed, as opposed to again looking at it a bit like a Faustian bargain: I get all these material benefits, but I'm going to have to pay for this bad behavior. If you lose sight of the fact that the behavior is bad or if somehow magically you convert that bad behavior into good behavior, you are not getting a real thick and rich moral sense of the tradeoffs that are at stake when we allow self-interests to flourish.

Smith is always wrestling with those concerns, and early proponents of capitalism who recognize the bad behavior that comes along with simply opening up the world to all pursuits of self-interest are always in that balancing act. When we stop engaging in that balancing act, it's not so much that things fall apart but that everything goes topsy-turvy. The problem is there are social costs to that.

Again, with someone like a Joseph Schumpeter, we tend to focus so much on creation, but we have to focus on the destruction as well because the destruction can overwhelm the creation. Schumpeter always had an eye on that because he was a good reader of history. I think maybe we have taken our eye off of that a bit.

DEVIN STEWART: Before we get to some of the ways we can maybe fix our capitalism, I want to get to your movie and book reviews because not only do you teach at University of Chicago Business School, but you also are a prolific writer for The Atlantic and other publications.

You have reviewed Wall Street, The Wolf of Wall Street, American Psycho, and Donald Trump's The Art of the Deal. Why did you pick those four things to review, and what can we learn from that?

JOHN PAUL ROLLERT: In the first three cases, I chose them because I think that they are—in the case of, say, Wall Street and The Wolf of Wall Street—two movies that in different respects capture the culture of capitalism, which is something that is very interesting to me, and American Psycho in a slightly different way as well.

I think what they attempt to do in each of those cases is point out certain elements of capitalism that bear greater attention, in the case of American Psycho, the kind of dangers of an empty materialism that can sometimes attach to capitalism. Endless pages in Bret Easton Ellis's book are spent on cataloging the clothing, the deportment, the jewelry, the music, the furniture, all of the accommodations of capitalism.

DEVIN STEWART: Have you read Crazy Rich Asians, by the way? It reminds me of that.

JOHN PAUL ROLLERT: I haven't, but I suspect it is probably very similar.

DEVIN STEWART: Maybe that is next.

JOHN PAUL ROLLERT: Yes. I have new things to review then.

Ellis does, I think, a great job of showing [how] the obsession with the accoutrements of capitalism helped paper over spiritual hollowness.

In the case of a movie like Wall Street, you have an attempt to transform greed into a virtue. As opposed to greed being a kind of human motivation that has these secondary material benefits, greedy behavior itself becomes something to be embraced.

If I remember correctly, the way in which Michael Douglas's Gordon Gekko character describes it, he says: "Greed is not just good. Greed is right. Greed works." That's a very strong statement that goes far beyond anything that someone who's morally ambivalent, like an Adam Smith, would ever want to wrestle with. I think in the case of Wall Street there was an attempt to provide a particular vision that was shocking, say, in 1987.

What is interesting about The Wolf of Wall Street, which comes out almost 30 years later is that in that case, I think there's a sense where any kind of moral reservations have been cast aside. It's a pure kind of capitalist Bacchanalia.

At the time I think for a lot of people there was the feeling that an individual like Martin Scorsese was celebrating capitalism by doing this, by not inflecting it with moral ambivalence.

I actually think that is a wrong way of reading it. I think what makes the movie so damning is an unwillingness to present it in overly moralized terms but just provide this kind of vivid, technicolor, morally decadent portrait of what becomes of capitalism and allows the viewer to draw the conclusions himself.

DEVIN STEWART: It's a warning sign.

JOHN PAUL ROLLERT: Yes, a warning sign. To the degree that we don't actually take those warnings, it may say more about us than I think it ultimately does about the movie.

In the case of The Art of the Deal, look, we are coming to grips right now. We sometimes forget this is our first business president. For decades, I think especially on the right, people have talked about the virtues of bringing a kind of CEO vision to American leadership and politics.

While it is true that Donald Trump has always run a family-owned company so he is not a conventional CEO, we right now have a test run with our kind of CEO president. Insofar as I wrote this piece when Donald Trump was running for president, I wanted to get a sense of what we might expect from a Donald Trump presidency.

For me the most interesting takeaway from The Art of the Deal as is relevant to our discussion is that Donald Trump's vision of capitalism is much more of an almost primal or clannish vision of capitalism.

Someone like a Milton Friedman wants to say that one of the beauties of capitalism is that when people get together and voluntarily cooperate in a commercial exchange, each side wins, or at least wins to a relative degree.

Trump doesn't buy that for a second. He is very honest about the fact that any business transaction is about one winner and one loser, and any transaction he goes into, he wants to ultimately be that winner.

There is a sense in which you can anticipate, when you read a book like The Art of the Deal, how he would treat competitors, say in an electoral season. You can anticipate how he would engage counterparties in any kind of trade deal or deals connected to international diplomacy.

You can I think anticipate to some extent not just the behavior we have seen in his presidency but some of the shortcomings in his ability to actually get deals done, because essentially he doesn't seem to understand the fundamental notion of the division of powers is that it militates in favor of compromise, and compromise assumes that both sides win something. For him, it is a winner-take-all exercise no matter what the situation.

DEVIN STEWART: Do you think there is some sociopathic element to that?

JOHN PAUL ROLLERT: At the risk of not being someone who is medically qualified to issue such verdicts, I think there is certainly a sense that for him in any kind of engagement you proceed not with the assumption that it is cooperative by nature or that you are engaging a friend or neighbor—and that is an assumption that Adam Smith always has—if your assumption is that any person on the other side of the table from you is an enemy that must be beaten and subdued, and he does believe that, there is no doubt that there is a kind of sociopathic undercurrent to that kind of approach not just to capitalism, in general to business, but also to contemporary politics and diplomacy.

DEVIN STEWART: We are going to get to the audience really quick, just one last question. How do we fix capitalism? You have pointed to Adam Smith and other thinkers. You also have written about Benjamin Franklin, who might be another person you want to think about when trying to fix our current state of affairs. Any advice on fixing our capitalism?

JOHN PAUL ROLLERT: One insight that to me is worth pondering over is that when you read someone like an Adam Smith or a Benjamin Franklin, the cooperative element of commerce is always stressed.

Early theorists when they discussed capitalism would often compare it to warfare. They would say, "Look, in warfare we are competing in this destructive fashion," but the great element about commerce is there is that competitive element, but it is always constructive in nature. For it to be constructive, you have to have a sense of loyalty, trust, and faith. For individuals like Adam Smith and Benjamin Franklin, that cooperative nature to commerce was absolutely essential, and the virtues like loyalty, and trust, and faith that underpin it.

To a certain extent, I feel like we have lost sight of that to a great degree. You can be competitive without feeling as though the person you're engaging is an enemy or someone who must be destroyed.

I think we see this in the best sense in competitive sports. Teams compete. They go onto the court, they play by a set of rules that they have both agreed to beforehand, and at the end they shake hands and go home. One person perhaps wins and the other person loses, but there isn't an assumption that you will leave as enemies.

I think for someone like Smith and Franklin looking at contemporary capitalism today, to the degree that people feel as though capitalism has become this kind of winner-take-all scenario, that gives rise to a kind of behavior, deportment, and engagement that I tend to think is far more destructive than it needs to be.

I think one of the ways in which we can begin to rehabilitate capitalism—because, I'll be very honest, Devin, I think we are in a very anxious moment in our history, and I think there is the possibility that all of the good things we can hope for from capitalism as a system could be hazarded either by making a track way to the left or way to the right. The question is how do you keep the good things capitalism provides while reviving a sense of faith in the system?

I always tell my business school students, who arguably stand to gain the most materially from their engagement in capitalism, that they can't take for granted the faith people find in the system. If you look at polls that are done of people who are under 30, they don't necessarily believe that capitalism is obviously the system that they need to embrace and go with, which means that their own sense of faith in the system has diminished.

I think the way in which you revive that faith is not by focusing so much, or at least exclusively, on the material benefits of capitalism and more by how do you revive that sense of loyalty, faith, trust, and also fairness in the system. The more there is that sense, the greater there will be that sense of faith in capitalism and the more in which perhaps we can turn things around from where they are currently headed.

DEVIN STEWART: Excellent. I am reminded that human beings are described as animals that both cooperate and compete. We just have to remember the cooperate part.

Let's get to the audience questions.

QUESTION: Western society was discussed at length. With the rise of China and this quasi-capitalist-communist social structure, has the idea of greed and ethics changed in any way?

JOHN PAUL ROLLERT: I think one of the interesting things about the rise of the Chinese alternative, we'll call it, is that as someone who has taught business ethics now for almost 15 years, I would often say that if I were teaching business ethics 40 years ago, I would have had to take seriously communism as an economic alternative.

After 1989 and the fall of Soviet communism, there didn't seem to be an obvious wholesale alternative to capitalism as we know it. There are going to be important differences in the form of capitalism between the United States, France, Germany, and South Korea, but the basic idea of embracing free markets and individual liberty seems to be the way in which people generally agree to go.

The interesting thing about the rise of the Chinese alternative, and to the degree that it is successful, it's going to really complicate how we think about Western-style capitalism and the tradeoffs that are inherent in that particular vision of capitalism.

You can see it being the case in 15 or 20 years—particularly I think at the point at which the size of the Chinese economy catches up to the United States—that people will inevitably take very seriously China as a possible alternative, which will raise broader questions about the degree to which individuals pursuing their own self-interest ultimately lead to the greatest material benefits.

We take that for granted. That is a fundamental assumption of the invisible hand. But to the degree you have an alternative where a centralized body makes a disproportionate number of decisions leading to a commercial state that seems to rival at least the one that we are comfortable with, the moral status of greed I think will be brought into question in a way that we haven't even begun to recognize and wrestle with.

I think you are absolutely right that China as an alternative will complicate the way in which we think about capitalism in many different ways, some of which may be for good.

Looking at China as a rival system is something I spend a lot of time doing, and I think it is wise for others to look at it as well, too, not just in hard, technical economic terms but also the moral assumptions we build into the capitalist system.

QUESTION: Is it human nature to be greedy, or are we just morally deprived and using material consumption as a way to cope?

JOHN PAUL ROLLERT: That is a great question. There is the question of whether or not by nature human beings are greedy. I think certainly there is no doubt that there is a selfish instinct that is universal to all of us. I think the harder question is wrestling with the degree to which our social conditions make us more or less inclined to be greedy.

Just because we do have those selfish instincts doesn't mean that society doesn't in some way cabin those. Think of children. Parents spend a lot of time trying to form children so that they are constructive in their behavior. We don't just take for granted whatever passions they show us at age two and try to accommodate them. In fact, we tend to believe that if we did that, very bad things would come about. I think with respect to greed, the thing we wrestle with a great deal is maybe less whether or not people are greedy by nature but how much should we accommodate and nurture that instinct?

This was not a concern 400, 500, or 600 years ago. The desire to be greedy would be seen the same way as, I don't know, a murderous instinct, a kind of rage or wrath. There was no belief that nurturing rage or wrath was ultimately anything other than a morally dangerous proposition.

What changes in respect to greed in the 17th and 18th centuries is the people say, "Well, actually nurturing this instinct to a degree has material benefits that are greater than the drawbacks that come about by virtue of it."

I think something that we have to wrestle with today is whether we have overly nurtured and overly embraced greed, because the fact is whatever material benefits that come from allowing people to pursue not just their self-interest but sometimes their selfish instincts, there are going to be offsets in the process and drawbacks.

We sometimes lose a sense of those drawbacks, and one of the ways in which we lose sense of them is we just take for granted that everybody is greedy, and therefore we are simply accommodating an instinct we will see it all times and everywhere to the same degree. What we should really be asking ourselves is whether or not we are taking an instinct that can be destructive and inflaming it in ways that go far beyond any benefits we can hope to reap from it.

QUESTION: Capitalism, as you talk about, has constantly morphed and has undergone dramatic changes in the course of American history, particularly during the 20th century. When you talk about FDR's Keynesian-inspired New Deal policies and their effect on how Americans' attitudes were toward social welfare from the 1930s to the 1960s to the more free-market-oriented attitudes and policies of the late 20th century, how would you define contemporary American capitalism, or at least—because it's probably such a difficult term to define, what would be some of the signature features?

JOHN PAUL ROLLERT: That is a great question, and it's a big question, so let me describe one way that I frame it for a lot of my business school students, and that's in terms of thinking about the iconic figures of capitalism at any given moment.

There is a sense in which I think today the popular consciousness around capitalism is claimed by two different types of figures. I think more familiarly to a lot of us, and a figure that has a longer-standing claim on the popular consciousness, is the classic baron of high finance.

You can think of, say for example, a figure like Gordon Gekko. I think one of the enduring qualities of a movie like Wall Street is that in presenting a figure like Gordon Gekko, it provides a behavioral vision of what capitalism should be like. You can watch a figure like Gordon Gekko and say to yourself, "This is what it means to be engaged in capitalism." Of course, what it means is to be engaged in a particular element of high finance, and obviously there are a lot of moral decisions that go into the behavior you see reflected there.

But I tend to think for my students—and people tend to think in simplified terms—that is one figure that has a claim on the way in which we think about capitalism.

I think the other figure—and this has taken shape over the last 15 years—is the figure in Silicon Valley. The Silicon Valley titan looks and seems very different to us than the master of the universe from high finance.

I do think there are different kinds of behavioral tendencies. Whereas someone like a Gordon Gekko's unapologetic celebration of greed and everything that goes along with it, of prizing one's own personal self-interest materially speaking, and taking for granted that behavior consistent with absolutely prizing someone's self-interest will always be conducive to the common good.

If you think of these figures in Silicon Valley, they often talk more in terms of a commitment to the general good. There's a belief that—whether it's an application or a particular website or some kind of device, say in the case of Apple—what they are committed to, in really concrete and obvious ways and not necessarily by the invisible hand, some indirect way, they are making the world better.

Of course if you watched Mark Zuckerberg's testimony a few weeks back, a lot of people are maybe not entirely convinced that all of these applications and opportunities do in fact make the world better.

But if I am thinking about the types of individuals that my students or young business students really admire, and if they're thinking about how they frame their behavior, I think the master of the universe in the high finance vision on the one hand and the Silicon Valley baron with his hoodie on the other hand provide two different moral points of gravity within capitalism, each of which pull us in very different directions with very different visions of the possibilities of capitalism and also the moral possibilities for the capitalist.

QUESTIONER 4: What is your response to universal basic income?

JOHN PAUL ROLLERT: I think the universal basic income is a fascinating proposal for a number of different reasons. One of my favorite reasons is that historically speaking it was something that, most famously in the 1970s, no less than Milton Friedman thought was the best way in which to address concerns of social welfare.

In his own case he didn't like the idea that the government would be involved in such kind of activity, but he felt that if it should be involved, it simply should just make direct cash transfers as opposed to setting up complex systems consistent with a large social welfare state.

What is interesting to me today is to see this issue come back into vogue, not just on the left but also on the right, as one way of dealing with what seems to be a kind of abiding problem not so much of equality but of opportunities available to people to work.

I go back and forth a little bit on the universal basic income. I am maybe a little bit more excited by the idea of job guarantee or wage supplements. I think work has a kind of dignity that is attached to it, and we have to think broadly.

A lot of the women who take my classes want to ask about the status of work for young mothers and how do we think through that. It is a complex matter, but I think there is a certain dignity in being engaged in work.

I think the key thing is that when that happens, people have to be rewarded. One of the problems we have today are so many people who work incredibly hard aren't duly rewarded for their work.

Now it may be the case—and I know I'm not an economist, but a lot of economists at the University of Chicago like a minimum basic income because they just don't think there will be enough jobs available, and with the rise of the machines, a kind of job guarantee or near job guarantee will only end up in creating a lot of useless jobs. Maybe that is the case. I fundamentally myself don't know, and I can understand why, if that in fact as a pure economic matter is the case, why universal basic income makes sense.

But I do think that regardless, the fact that concerns such as the universal basic income have come back into vogue suggests that capitalism is coming up short. If you can't find enough jobs for people and if you can't find not just enough jobs but good jobs for individuals, in some ways capitalism is stumbling.

In an affluent society, one thing you always have to consider is that when the invisible hand doesn't do the work it needs to do, there's enough to end up redistributing to pick up the slack. I think something like a universal basic income is one possible opportunity.

I am kind of excited by the fact that people are thinking in unconventional ways how we can address popular social problems. I myself have not studied the issue closely enough to know if that is the obvious remedy or others, but it is clear that something is not working. I think the very polls I described earlier where people consistently suggest that they are losing faith in capitalism say that we have to think creatively and try out new things.

There is the wonderful story of FDR during the New Deal where he is trying program after program, and his ethos is: "We've just got to do something. Throw things against the wall, see what sticks because the problems are pressing enough."

Now the problems we face right now are not nearly as pressing as they were in the Great Depression, but they are pretty pressing. For people to stand up and offer creative ideas to address them, I'm all for it.

DEVIN STEWART: John Paul, thank you so much for speaking with us here at Carnegie Council in New Your City and also for meeting with our Carnegie New Leaders program.

You mentioned Adam Smith said it might be important to get to know your local brewer better, so we would like to take you up on that offer and introduce you to our local brewer in our neighborhood of Manhattan here, after this.

John Paul Rollert is a professor at the University of Chicago Booth School of Business.

John Paul, thank you so much again.

JOHN PAUL ROLLERT: It has been a real honor to be here, Devin. Thanks so much.