Peter G. Peterson tells his remarkable life story, from growing up in Nebraska, to advertising, to secretary of commerce under Nixon, to Lehman Brothers, and to the creation of The Blackstone Group, one of the great financial enterprises in recent times.

DEVIN STEWART: Welcome, everyone, to another Carnegie New Leaders-BGIA [Bard Globalization and International Affairs] program, with Bard and the Carnegie Council, another collaboration made possible by the hard work of Carter Page and his team, working very smoothly with Carnegie to bring you yet another fantastic speaker, a true Renaissance man, Peter Peterson.

It's very rare for us to have a person of so many accomplishments to speak to us, and even in existence today, guiding the policy debate and thinking about long-term, big-picture problems, as well as having quite a life, which he is going to share with us today.

I'm Devin Stewart, from the Carnegie Council. I welcome all of you. We hope that the Carnegie New Leaders and the Bard program can work together in the future and that Bard students will graduate into the Carnegie New Leaders Program. Carnegie New Leaders are people in their late 20s to late 30s.

Without further ado, I turn it over to the Director of the Globalization Program at Bard, Carter Page. Thank you very much.

CARTER PAGE: Thanks very much, Devin, and thanks to the Carnegie Council, Joel Rosenthal, and Devin, for cosponsoring this important event with us today.

Welcome to today's James Chace Lecture Series event. It's not often that you have an opportunity to introduce someone who has fundamentally impacted many elements of your life. Maybe the exception is when you introduce family members at a reunion or something. But today I have the great pleasure of doing just that for someone who has personally had a great impact on me—and, indeed, he is not related.

As just the tip of the iceberg, I would like to tell a quick story of my years as an International Affairs Fellow at the Council on Foreign Relations in 1999. It's a story reflective of Pete Peterson's reputation as one of the leading financiers in the world over the past 25 years. I spent the beginning of my year at the Council trying to get work done in a shared, cramped office with a few other fellows. About halfway through my fellowship, I was informed that the new Peterson Hall was about to open and I'd be moving to a different spot. Sure enough, a few days later, I moved into a high-tech new office all of my own, with a large fireplace.

It's hard to expect to receive more from someone who has given a gift like that, but, as I mentioned, the office, the building, the physical elements are just the tip of the iceberg. Pete's leadership as the chairman of the Council on Foreign Relations included initiatives to open the institution to new generations of individuals in the foreign policy community, which I was fortunate enough to take part in, and which, in turn, opened many opportunities for me throughout my career. The firm which he started, the Blackstone Group, is the gold standard among global private equity firms and, really, a leading model of excellence on Wall Street. With respect to Pete's achievements in government, Time magazine has referred to him as "the most powerful secretary of commerce since Herbert Hoover."

This leads to the obvious question: How did he do it? I would like to just throw out there one possible explanation. Pete's career closely parallels the framework taught in the Bard Globalization and International Affairs Program by marrying real, practical action during the day and thinking about big-picture issues in the evening.

More specifically, in addition to his accomplishments in business, government, and the nonprofit world, he's a very serious scholar as well. The books he has written include Running on Empty: How the Democratic and Republican Parties Are Bankrupting Our Future and What Americans Can Do About It, and Will America Grow up Before It Grows Old? He has also written Facing Up: How to Rescue the Economy from Crushing Debt and Restore the American Dream, and while I was at the Council on Foreign Relations, he wrote Gray Dawn: How the Coming Age Wave Will Transform America and the World.

So for our students in the audience, when you're writing your final papers and exams in a few weeks and need to continue working at your organizations, here's living proof that finding this balance is indeed possible.

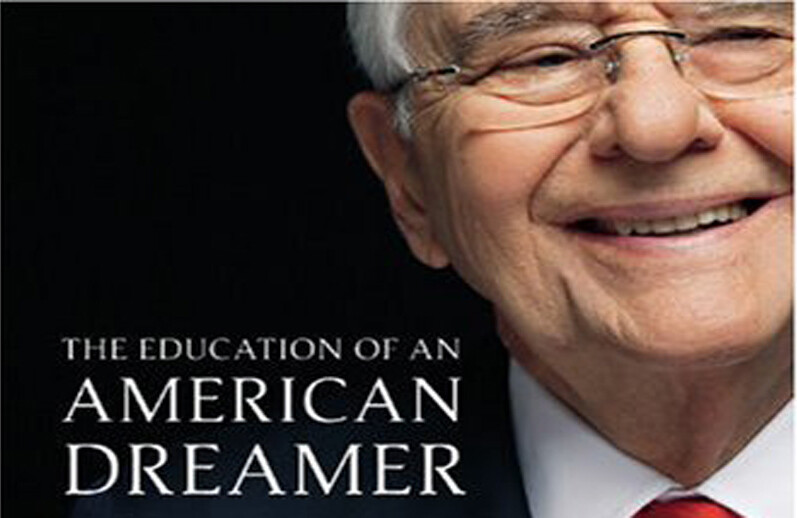

Today Pete will be discussing his recently published memoirs, The Education of an American Dreamer: How a Son of Greek Immigrants Learned His Way from a Nebraska Diner to Washington, Wall Street, and Beyond. Given the impact that Pete has had on me and so many colleagues at the Council on Foreign Relations, on Wall Street, and in government, it's a tremendous honor to welcome him to this forum.

Just a quick mention. The James Chace Lecture Series is cosponsored by Foreign Affairs magazine, and we're very proud to have them as our cosponsor, along with the Carnegie Council.

Please join me in welcoming Pete Peterson.

PETER PETERSON: Thank you. I was surprised, and a little disappointed, that your office included a fireplace. I had not envisioned anything quite that grand. I'll have to look into it.

I also deeply appreciate your mentioning my books. I desperately need the revenues, as you might imagine.

If you're pompous enough and presumptuous enough as a businessman to write books, you have to be prepared to be roasted. At the Council, one of the great roasters of all times is Ted Sorensen, who was President Kennedy's famous speechwriter. About one of my books, he said, "This is a book that, once you put it down, you will not be able to pick it up." (Laughter)

On another occasion, he said, "We're here tonight to anoint Peterson into literary sainthood. When I think of him, I think of St. Paul, the dullest town in America."

Finally, he said, "I would like to introduce the ultimate self-made man—and, oh, does he worship his creator."

Think about that one a while. It's pretty devastating.

You mentioned my Greek immigrant background. Let me say that the American dream has been very real for me. I call myself in this book an American dreamer. What troubles me is that today the majority of American people—and children—do not believe the American dream is going to be there for them. Neither do I, unless we change our ways in some very fundamental ways.

The foundation that I have set up will devote itself to certain challenges that we call undeniable, unsustainable, but politically, at the moment, untouchable. I want to repeat, we're focusing on long-term challenges. There's plenty of focus in America on this month's economic challenge. There is much less focus on the longer-term challenges that threaten our future.

I want to warn you up front that this is not going to be a charismatic, inspirational-type speech. In the first place, I have negative charisma, and in the second place, I'm a great believer in the fact that an informed democracy is the best form of democracy. I will lay out or answer your questions about how Americans have been misinformed, "dis-informed," as they say, by politicians, who have decided that you, the American people, can't take the hard, plain truths. And I simply don't accept that.

I am donating a great deal of my net worth—we had an unexpected windfall—I guess that's a redundancy; all windfalls, I guess, are unexpected—of over $1 billion when Blackstone went public. I decided I had enough, and I'm committing that money to this foundation that is focused on these long-term issues.

People question my judgment and often say to me, "Why do you think you can make a difference on such important issues?" The honest answer is, I don't know if we can, but I was, presumably, educated at the University of Chicago, in graduate school. We had a Nobel Prize winner there named George Stigler, who said one day, "If you have no alternative, you have no problem." I have thought a great deal about that and how much time we waste on problems where there isn't much of an alternative. But I've kind of played the alternative of spending the rest of my life doing nothing about these long-term challenges and lying there on my death bed and saying, "You know, you really felt that this great country that has so rewarded you in so many ways was in peril, and you sat there and did nothing about it." I decided that was not an alternative.

Something else played a role in my decision to commit $1 billion to this foundation. It's amazing how your life gets affected by stories you read. You all know who Kurt Vonnegut is, and Joe Heller, two great novelists. Kurt and Joe are at an outing in the Hamptons that is sponsored by a very rich hedge-fund operator, and Vonnegut says to Heller, "Doesn't it bother you that this guy makes more money in a day than you made selling Catch-22 all over the world?"

Heller says, "No, it doesn't bother me, because I've got something this guy doesn't have."

Vonnegut says, "What in the hell could you possibly have that he doesn't have?"

Heller said, "I know the meaning of 'enough.'"

That really impacted me. My wife and I decided that we had more than enough.

So let's discuss some certain unsustainable challenges. Some of you Democrats will have trouble believing this, but in the Nixon White House that I served, we actually had a Nixon comedian. That will certainly strike most of you as an oxymoron. He was a very funny person named Herb Stein. He used to say, "If something is unsustainable, it tends to stop."

"Or," he said, "if you don't like that one, if your horse dies, I suggest you dismount."

When we describe these problems as unsustainable, we Americans are behaving as though we can ride this horse for an indefinite period of time. To go a step further, I'm old enough now to remember that Lyndon Baines Johnson got severely criticized at the time of the Vietnam War for wanting to launch some domestic Great Society programs at the same time he was fighting the war. He got severely criticized for promoting "guns and butter." Look at what we're doing. We're having two wars. We not only have guns and butter, but we have tax cuts on top of it. I'm not aware of a single sacrifice that we have been asked to make in view of these decisions that have been made.

I'm going to focus on three of these unsustainable challenges: one, the so-called entitlement programs; second, the balance of payments and savings deficit problem; and third, our health-care costs. The reason I decided to talk about these things to a young audience is that it is you who are going to be stuck with the bills. As I'm going to try to point out, it will have a very profound effect on your economic future.

You've all heard that we have a public debt of $12 trillion or $13 trillion, and you've all heard that that has doubled, roughly, in the last ten years. What you have not been told is that off the books, hidden from public view, are $62 trillion of unfunded liabilities and promises that have been made that you are going to be expected to pay for in the future. That's over $500,000 per household. That's nearly ten times the income of the average household.

If you want to think of this in terms of taxes, to pay for these programs your taxes would have to double, having a profound effect not only on the economy, but on your standard of living, because payroll taxes, you probably know, account for about 80 percent of the taxes that the average American pays.

Now, as to reasonable interest rates, interest payments alone, if you look ahead 30 or 40 years, would be the size of the entire budget that we have today—just for interest rates—at current interest rates, and most people expect interest rates to be higher than that.

Quite a few people say, "Well, let's get rid of the Bush tax cuts, and that would take care of it." The growth of entitlements is nine times bigger than all of the Bush tax cuts, and very few people are proposing to get rid of all of the tax cuts.

Some people say, "Let's get rid of not only the Bush tax cuts, but all these damn earmarks, and let's get out of Iraq and Afghanistan." That would only cover 10 to 15 percent of these costs.

I'm trying to make the point that these are enormous liabilities that are going to require some very basic steps.

A lot of well-meaning Americans say, "We're in a very competitive world, and we're going to have to spend more on R&D and investment in the future." What happens when you run these kinds of debts is that often the most productive investments get crowded out by the expenditures that have political constituencies. For example, 40 years ago, the federal government spent 5 percent of its budget on R&D. That R&D was a very major force in some very important developments, including the Internet.

That is now below 2 percent of the federal budget, and that is true of virtually every item that could be reasonably called investment in our future.

There are some people who, I think, believe that you can "grow out of these problems." The General Accounting Office has estimated how fast we would have to grow to grow out of these problems. We would have to grow about five or six times faster than we have ever grown in this country to grow out of these problems. I don't know of anybody that believes that.

People say to me, "How can all this be true when the politicians tell us that, in the case of Social Security, something called the Social Security Trust Fund will be solvent until 2045?"

I have collected oxymorons since Time magazine said I was the most powerful secretary of commerce since Herbert Hoover. I always worried about that, because we know what happened to Herbert Hoover. But it was an oxymoron because anybody who has had that job knows there has never been a powerful secretary of commerce.

That has led me to collect oxymorons. My current favorite is the "House Ethics Committee." [Laughter]

It seems to me that we had better understand what the trust fund is really all about. It's an oxymoron because it shouldn't be trusted and it's not funded. Other than that, it's a totally respectable concept. There's nothing in the trust fund except liabilities. Whether you have a trust fund or not, you are still left with the same tough decisions.

You reduce the benefits, you try to borrow these huge amounts of money, or you increase taxes. The trust fund, other than having some political significance, is irrelevant, in any substantive sense of the word.

It is important, therefore, that we get to the subject of reform. If you want to talk about reforms, for example, in Social Security, there are four or five reforms that I think would make the system solvent for the people that really need it (and that's what this started out to be, a safety net for the truly needy, not for people like me): You can extend the retirement age, because we're living much, much longer than we did and are expected to, and index it to longevity; you could reduce the benefits for the well-off, in a variety of ways; you could increase payroll tax; you could adjust the indexing system—all things that are not draconian and can solve the problem and send a very important message to the rest of the world, that we're getting serious about our future deficits.

The second challenge that is very important is the balance of payments and savings deficit, which leads us to have to borrow extraordinary amounts of money from abroad. I asked the Institute for International Economics if they would look at how much money we now owe foreigners and how much we will owe foreigners if we continue on our current path.

The reason our foreign debts are growing so rapidly is that as a country we're gifted consumers that spend more than we earn, we have huge budget deficits, and—very, very important—we have very, very low savings rates. People say to me, "I don't know what you're talking about. After the Second World War, we had huge public debts, and we somehow managed to handle them." What we have forgotten is that we owed most of that money to ourselves, because we had a much higher savings rate in those days than we do now. Few things are more important to solving our long-term problems than saving more.

Here is where I'm very much interested in—and perhaps you can explain it to me—the psyche of young people, who, on the one hand, in very large numbers, say, "I don't believe Social Security will be there for me," and on the other hand, they're not saving anything. How they reconcile those two positions is something that I've always found quite interesting.

I will quote only one item from this Peterson Institute report. He said, "The projected path of foreign debt is so unsustainable and dangerous that a crisis would be virtually certain to occur long before the U.S. reached some of these points that we refer to in this report."

Let me add a couple of other elements—maybe I'll just overlook that, in the interest of time.

Let's move on, particularly in a building in which we're meeting today—and we discussed this briefly at lunch—to the relationship between America's debt and its deficits and America's foreign policy. I was telling the group that when I was in the Nixon White House, Henry Kissinger used to brag about his ignorance of economics. One day he said to me, "Peterson, you keep focusing on these minor economic matters."

I said, "Kissinger, to you, it's a redundancy. You think all economic matters are minor."

I want to urge those of you who are in international affairs that you're going to find that America's debts and deficits and future economic outlook will have a great deal to do with America's foreign policy and its ability to lead the world. If you doubt that, let me give you one example.

In the Eisenhower years, America then was a huge creditor nation and, like the Chinese today and the Japanese, had huge volumes of foreign securities that they owned. It was American foreign policy that we not have military activity in the Suez Canal. The British and, to some extent, the French launched a military effort to take control of the Suez Canal. We thought that was a very bad idea.

A senior officer of the Eisenhower Administration called a senior officer of the British administration and said to them, "We don't take kindly to this idea of your having a military presence in the Suez Canal, and unless you withdraw your troops, we will find it necessary to sell large volumes of our British pound securities." Ten days later, the Brits pulled out of the Suez Canal.

Now, it doesn't take an enormous amount of imagination to remind ourselves what leverage the Chinese in particular could have with regard to foreign policy or other American policies due to the fact that we are so dependent on them to finance our debts and deficits.

Recently, as I discussed at lunch, there is a unanimity among international economists that the Chinese currency is very seriously undervalued and that it is essential that it revalue its currency so that we can get these imbalances in better shape. Even though there's unanimity on the problem, we know that the Chinese government would rather not revalue in any significant way. So, in spite of the fact that it is overwhelmingly in U.S. interests to get them to do it, we are very reluctant to make this a major issue. That's just an example of how it affects our policies.

Richard Haass, the president of the Council on Foreign Relations, sent me something the other day pointing out examples of how America's weakening position in terms of international finance is affecting our ability to leverage international negotiations that are going on.

So I would urge all of you to ignore Henry Kissinger's early views that knowing something about geoeconomics is really not important and start getting yourselves educated on the linkage between economic power and foreign leadership. I'm corny enough to believe that America has a role to play.

There are a variety of scenarios about what will happen if we don't do something to reduce our borrowing abroad, but a substantial number of the people that at least I respect the most believe that one of the most serious threats to America's future will be a loss of confidence on the part of foreign lenders, who will either decide not to lend us money because they are very concerned about our fiscal sanity,or will charge much higher interest rates to reward them for the risk that they are taking.

I don't need to tell you that a big rise in interest rates and a big fall in the dollar will have very important effects on inflation, on growth in this country, on housing foreclosures, and so forth. So I think it's overwhelmingly important for America to send a signal to the rest of the world that we are taking these fiscal long-term structural issues very, very seriously.

We must, as a country, learn to save more. If you're interested, we can talk about how to do that. We were saving as much as 10 percent of our disposable income only 20 years ago. As you probably know, until very, very recently, we actually had negative savings in this country, not to mention our budget deficits.

Finally, our foundation is focusing on health-care costs, which I think young people should get themselves very much acquainted with because it is the most serious fiscal threat going on in the country today. To put this in an international context, we spend about twice as much per capita as does the rest of the world, with health outcomes that are a little less satisfactory than the rest of the world.

Unfortunately, even though these costs are much, much higher, the recent health-care bill that was passed does very, very little about the long-term outlook on health-care costs. Why do I believe that? There are several so-called cost drivers that we do very, very little about. I'm just going to mention a few of them to illustrate the problem to you.

First of all, we have a very perverse payment system, called fee-for-service, in which the more tests and the more procedures and the more surgeries the medical institutions do, the more they get paid. If you had hired me to be a consultant on coming up with a payment system that would maximize costs, I would have great trouble doing that. If you add the defensive aspects of medicine, where they worry about malpractice, to the fact that the revenues go up as they do more, you begin to understand why our costs are as high as they are. Let me give you a couple of examples.

Even though Germany's health outcomes are better than ours, we have five times the CAT scans per capita than Germany does. France has very good health outcomes. We do five times the heart bypass surgeries that they do. Wherever you look across the spectrum, you'll see enormous variations that are inexplicable and evidence of what's wrong with this situation and this payment system.

Another cost driver is regional variations that are simply inexplicable. Mike, I know in your business, you're running a global business. If you had one area that costs three or four or five times as much as something else, you would have had a proposed system of incentives or standards, and you would apply them throughout your business. But you wouldn't tolerate enormous variations in costs that are inexplicable. Let me give you some examples.

You know we have red states and blue states politically. But I didn't know we had "bad back states" and "bad prostate states." The facts are that there are areas of this country that have six times the back operations as other areas and six times the prostate removals. I doubt that we have "bad back states" and "bad prostate states." Rather, this is a function of a system that is out of control.

We are the only country in the world that doesn't have a health-care budget. It's totally open-ended. When you're running a business, there's nothing like a budget to make it important for you to make decisions about priorities. In our case whatever the costs are, they are, which I think is unthinkable.

On the last year of life, 30 percent of what we spend in Medicare is in the last year of life, substantially more than other countries. Yet, if you look at the politics, we've done nothing about that issue. If you look at the politics of Terry Schiavo and, most recently, the death panels, you begin to see some of the difficulties of dealing with it. But we must deal with that issue in a benign and compassionate way.

It raises some very profound—this is a group that deals with ethics—some very profound ethical issues and practical questions that are not just religious, but they're very pragmatic. For example, is it the government's obligation to prolong life indefinitely or is it only to prolong life as long as there is a reasonable quality of life that is maintained? In other words, is the government responsible for very costly interventions in the last weeks and months of life or not? Are there some approaches that leave these very difficult decisions to the people, but encourage them to make decisions?

For example, in Wisconsin, there is an important city, La Crosse, Wisconsin, where 95 percent of the population, due to an internal program, has living wills. In that particular county, their Medicare costs are 20 percent lower than other comparable areas.

It's an issue that we have to confront.

I mention all these cost drivers because we haven't done anything about any of them in the current health-care bill. It's going to require some very tough choices.

What do we do about all this? There are several important ingredients. I'm not trying to understate how difficult they are politically.

First of all, presidential leadership is utterly essential. I can't imagine a solution without an actively involved president.

Secondly, it has to be bipartisan. I was brought up in Nebraska, and we used to have something called the turkey shoot phenomenon or the pheasant shoot phenomenon. If you went out hunting, the poor turkey that lifted its head first got it shot off. Politically, if a member of one party suggests that we need to reform Social Security in the following ways, you can imagine how quickly they would have their head shot off. So they have to get together and, arm in arm, move forward.

Notice what happened recently on this bipartisan commission. It's the first time I've ever seen this happen. Without getting into some boring details, there is much to be said for a so-called structural bipartisan commission in terms of getting results. But that requires legislation. Seven Republicans sponsored the idea of a structural bipartisan commission. When they heard that Obama, the president, was for such a commission, they withdrew support for their own proposal.

I've been around Washington a long time, 30 years or more. It's the first time I've ever seen anybody vote against their own proposals. But it gives you an idea of the partisanship that will cause any program to fail.

I think it is very important that we get several constituencies involved in the solution, quite apart from bipartisan commissions. The two co-chairmen of the current commission, Alan Simpson and Erskine Bowles, are absolutely great guys, and I'm encouraged that we might have a shot with them running the activity. There are several constituencies that we have to get involved. It seems to me young people are going to be one of them. I would be very much interested in your ideas. But you remember the old joke in the philosophy class, where the professor says to the class, "Which is worse, ignorance or apathy?" And some kid from the back says, "I don't know and I don't care."

The attitude of too many young about these subjects is, "I really don't know much about it and I don't much care." Let me assure you young people, this is about your future, not mine. That's one constituency we are trying hard to get involved.

Ultimately, the issue I'm talking to you about—and I'm glad to do it at an institution involved with ethics—is a moral issue. I know how convincingly that comes from a Wall Streeter. It was Dietrich Bonheoffer, the German theologian, who once said, "The ultimate test of a moral society is the kind of world it leaves to its children." I think the idea that we're leaving to our kids and grandkids unthinkable taxes, unthinkable debts that affect their future and that are hidden from view, is utterly immoral and unconscionable.

We're having meetings at the foundation with members of the religious community. We had a big one this morning with one of the leading members. You may recall that recently a couple of very important religious organizations got involved on the climate change issue, which surprised a lot of people. They decided they would support it on moral grounds, on the grounds that it was immoral to pass on an environment to future generations that was as degraded as it's going to be if we don't do something. That's very analogous to what I'm talking about, and we're getting a very good approach.

Ultimately, what we're going to have to do is to make it unsafe for politicians to do nothing. At the present time, the politicians have decided that it's safer in getting reelected for them to do nothing than to take on these tough issues. We have to make it as tough, and maybe a little tougher, not to do anything as it is to do something.

That's going to require the support of a lot of people, but in particular the young people.

Thank you very much.

QUESTION: In your book and in today's speech, you mentioned that our debt addiction is killing us and that we have to start saving more. How do you persuade the younger generation to save more? How do I save more?

PETER PETERSON: I was asked in the mid-1990s to chair a commission, by the White House and the Congress, on capital formation in America, particularly savings. It was a very interesting experience. I got the smartest savings economists across the political spectrum—left, right, center.

They don't often agree on anything, but they agreed on the fact that the current incentive program to increase savings is not effective. I asked them why, and they said that a lot of the people who take advantage of those tax incentives, 401(k)s and so forth, would have saved anyway. It costs quite a lot of money, and the net increase in savings after the cost tends to be small.

I said, "Look, we're here to increase savings. Let's not just be negative. Tell me what you think we have to do."

They indicated something that I think is largely true: In recent years, we have been so consumption-motivated, so "I want it all, I want it now, and I don't want to pay for it"—as I said, I heard a young person on CNN yesterday, on a program we're on, say that we're socialists when it comes to spending and libertarians when it comes to paying for it. There is such a preoccupation with being entitled to spend it now that it's very hard to get them to think seriously about the future.

I said, "All right, what do you propose doing about it?"

They said, "We believe that you're going to have to have mandatory or automatic savings."

I said, "What do you mean by that?"

They said that people will be required to save, but unlike Social Security, where the money went into a trust fund and the government spent it, the money would really be saved and invested.

I know that sounds harsh, but that's exactly what Singapore has done, what Chile has done, what Australia has done, to have an automatic savings plan. I suspect that is one of the things.

The other thing, which is not a very positive approach—our savings rate has gone up a bit in the last year or two, but that's out of fear. People are scared. When the economy does better, I'm afraid that we'll see the savings rate fall again. But it's still far below what it used to be. We used to be one of the biggest savers in the world.

Lest you get totally discouraged about this, I want to remind you that post-World War II public debt in the United States was 122 percent of the GDP. It's now under 60. What did they do, after that "greatest generation"? By 1980, we had reduced the public debt to 23 or 24 percent of the GDP. So we not only paid down the debt, but we invested in the biggest infrastructure highway program in the history of America, we launched the GI Bill of Rights, which was a very expensive program, we paid for the Marshall Plan, which was not very popular at the time, we launched the United Nations—a whole set of initiatives—and we paid for them.

I don't want to sound like Americans have never been resilient and responsive, but they responded to leadership, not just the political leadership but the business community on these longer-term subjects has been called missing in action. The business community had a great deal to do with the passage of the Marshall Plan, which was very unpopular at the time, because the American people wanted to withdraw from the world, and they were persuaded that an enlightened growing world economy was in our interest. They sold that idea. We need the business community to get involved.

QUESTION: As someone who has had experience with negotiations with China, at a time when relations were a bit more tense and we weren't as dependent as we are now as far as economic issues, what kind of compromises or approach should the U.S. take in negotiations to have it benefit both the U.S. and China? Because that's needed going forward.

PETER PETERSON: There are few things that I think would help in those negotiations more than to reform our fiscal picture. I can assure you, from what experienced people are telling me—and they are beginning to go public—privately the Chinese are expressing a lot of concern, because, among the other factors they consider, they don't like the spot they're in. They have $1.4 trillion of Treasury securities that will fall in value dramatically if we don't do something about it.

So they have not only an economic reason to support reforms, but it would be something that would give us more leverage in the negotiations. Now we don't have much leverage. But if we could say, "We're putting forth this program. We would like you to do something about your currency," for example, it's much more likely that you would be successful. In other words, "We did our part, which you've been urging us to do. Why don't you do your part?" But now we don't have that leverage.

They would like us to reform this financial outlook because of the risks it poses to them. The risks are twofold: one, the value of their $1.4 trillion would fall significantly; and secondly, they would lose a growing American market that they very much enjoy at the moment. So they have a huge interest in America making a recovery and getting its financial affairs in order.

QUESTION: First of all, I'd like to thank you for coming to speak to us young people.

PETER PETERSON: Well, they pay a lot, as you might imagine.

QUESTIONER: Also I just wanted to say that whoever said that this is a book that you're going to put down and won't want to pick back up—I want to say that this is one of the first books that I've read and I could associate with. You wrote that you had two outfits when you were a kid. You had one where you would have your shirt unbuttoned, khakis, and then you would have a suit when you were dealing with the rich people. This is the one suit that I own.

With that in mind—

PETER PETERSON: I'm asked for a lot of contributions these days. I didn't realize that it went quite this far.

QUESTIONER: As I'm trying to go out there, and I have my goals and aspirations, all I know how to do is save because I have no income, first of all. But I'm also getting these phone calls from Wells Fargo—"Oh, you have great credit history. Why won't you sign up for a credit card?"

I don't want to sign up for a credit card, because that's how I know that people have been getting in trouble.

Why is there no regulation on that front, on the credit spending? Why are those people still making phone calls to me?

PETER PETERSON: Do they know you don't have any income?

QUESTIONER: They do.

PETER PETERSON: Mike, do you have an answer to this? It doesn't make much sense to me, after all the losses they have taken.

That, of course, is what happened in the mortgage area. It will go down as a classic—I have a friend who was on the Fannie Mae board—of a very toxic mixture of politics and economics. The politicians demanded that Fannie Mae put out a maximum number of subprime loans to people who couldn't afford them. Why did they do that? Because it was politically very attractive to be able to say, "We took care of these less well-off people."

But because they couldn't afford the mortgages, they had to foreclose, so we end up with the taxpayer picking up the costs of loans that should never have been made in the first place. The reason they were made was not sound finance, but it was the Congress that provided the money for Fannie Mae, and therefore they had a lot of leverage on them.

One of the anomalies in the American government is the Fannie Mae/Freddie Mac thing, which pretends to be a market-oriented financial institution, and it's largely a political institution.

I don't know whether that answers your question or not. I'm not sure the regulators would want to spend a lot of time on someone with zero income, but perhaps they would out of compassion. But I would hope that when they finally saw that you had no income, you wouldn't end up getting a card. I would hope so.

QUESTION: Mr. Peterson, what are your thoughts on energy policy, especially as it relates to the deficit and oil imports?

PETER PETERSON: There are three kinds of tax reform that I would like. I would like to see us move toward a consumption tax that's progressive, the way the rest of the world has. If you want to increase savings, another thing you do is make it more expensive to consume. You can't consume and save dollars. So that is a positive effect, that it leads to more savings if you disincentivize consumption. And you can do it in such a way that it's progressive, where it has far less impact on the poor than on everybody else.

The energy sector is the second area that we have to look at—what are called tax preferences and subsidies. They amount to a stunning amount of money, about $1 trillion.

Two of the big ones are the mortgage tax deduction for $1 million and making health-care expenses tax-deductible, so that companies have an incentive to give very rich health-care programs, since they don't cost the beneficiary anything.

But the third area would be energy taxes. The rest of the world—virtually all have energy taxes. The last time I checked the number, energy taxes in Europe were—maybe I don't remember it accurately—$3 a gallon, $3.50 a gallon, or roughly ten times what they are in this country. You could work out a system in which the energy tax was refunded, for example, with a lower payroll tax or something of that sort.

But I think it clearly should be part of our package. It's one of the things that makes our balance-of-payments deficit so high. For a while, the energy bill was about half of our trade deficit. It's a very useful way of reducing our imports generally and improving the environment. So I think it's a hugely important factor, but again the politics are very toxic in this country toward increasing energy taxes. But from a policy standpoint, it makes a lot of sense.

QUESTION: It's quite fashionable today to demonize and blame Milton Friedman and his legacy and influence for the mess we are in today. You are certainly not an orthodox follower of Friedman's teachings. But my question is, what is still today applicable in Friedman? Has he really had that devastating an influence on the state of affairs today or not?

PETER PETERSON: He was one of my professors—never known for excessive ambiguity, as you probably know. I'll give you an example.

When I was offered this White House job, I was CEO of a company making ten times or 20 times as much as I was going to make in Washington. I didn't want to make the move unless I thought it was a sensible job. I went to have lunch with Milton at the Quadrangle Club on the campus. I described the job to him. I said, "Milton, do you think I should take it?"

He said, "No, for the following reasons. With floating exchange rates, the job is unnecessary, and without them, it's impossible, and someone your age"—I was in my 40s at the time—"shouldn't be taking a job that's unnecessary or impossible."

He always had very clear views on things. But he had a great influence on me, because I remembered that. You may recall, on August 15, 1971, we moved from the gold standard to a flexible floating-exchange-rate system. You think you have a mess now; just imagine where we would be with the gold standard at the present time. So he had a major impact on me.

So did George Stigler. George had a marvelous sense of humor that I try to remember. He called me one day, on a Thursday. I taught part-time at the University of Chicago at night. Stigler said to me, "Peterson, I hate to be in such desperate shape that I would have to ask you to make a talk, but the guy that's supposed to speak at the Executive Club tomorrow at noon has just cancelled, and I'm truly desperate, or I wouldn't call you."

I said, "Thank you very much."

I accepted. It happened to be the day that I was named president of Bell & Howell, at a ridiculously young age. He had a one-line introduction. He said, "I'd like to introduce you to the president of what used to be called a growth company." That was the totality of the thing. [Laughter]

George not only had that "if you have no alternative, you've got no problem," he had a lot of other pithy examples. As you may recall, he did classic studies on what happens with regulatory agencies in Washington, and he showed that how they started out often was to protect the public, but how they ended up, usually, was to protect the industry that they were supposed to regulate. I have tried to carry that in my mind.

It was a great place to get some humility. I don't know how successful they were. I thought of myself as pretty smart as a summa cum laude from Northwestern, until I went to the University of Chicago, where they have four Nobel Prize winners that were teachers. I learned there the difference between a first-rate intellect and a first-rate second-rate intellect. They were just remarkable brains.

I think maybe we ought to go home. Thank you all very much.